All Categories

Featured

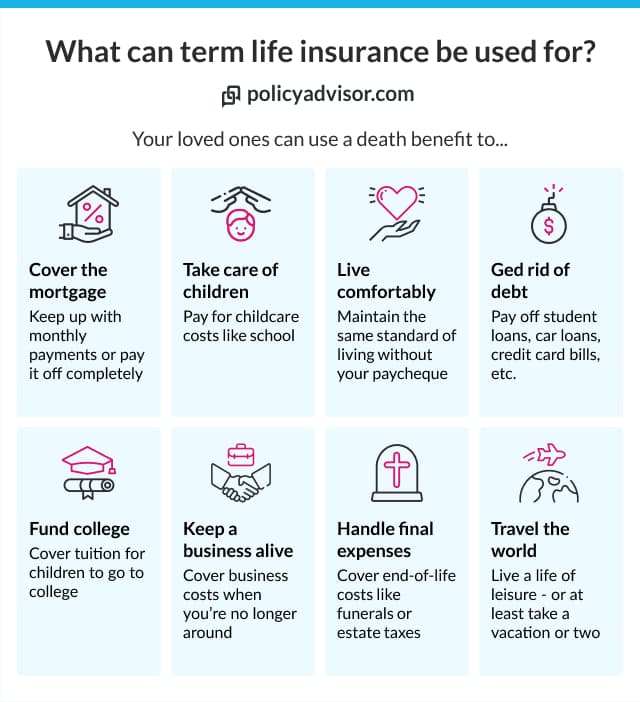

Take Into Consideration Using the DIME formula: DIME stands for Financial debt, Income, Mortgage, and Education. Overall your financial debts, home loan, and university expenses, plus your salary for the number of years your household requires security (e.g., until the youngsters run out your home), which's your insurance coverage demand. Some financial specialists calculate the quantity you require utilizing the Human Life Value philosophy, which is your life time revenue potential what you're gaining now, and what you expect to gain in the future.

One means to do that is to try to find business with solid Financial stamina scores. term life insurance for parents. 8A firm that underwrites its very own plans: Some business can offer policies from an additional insurance company, and this can include an extra layer if you desire to transform your policy or down the road when your family members requires a payout

Is 20 Year Term Life Insurance Worth It

Some firms use this on a year-to-year basis and while you can expect your prices to climb considerably, it might be worth it for your survivors. An additional way to contrast insurance policy business is by looking at online customer reviews. While these aren't likely to inform you much about a business's monetary security, it can inform you just how easy they are to work with, and whether insurance claims servicing is a trouble.

When you're younger, term life insurance can be a simple means to protect your loved ones. As life changes your financial top priorities can too, so you may want to have entire life insurance coverage for its lifetime protection and added advantages that you can use while you're living. That's where a term conversion comes in - what is extended term life insurance.

Approval is assured no matter your health. The premiums won't enhance once they're set, yet they will certainly go up with age, so it's an excellent idea to lock them in early. Figure out even more about how a term conversion works.

1Term life insurance policy supplies short-term security for an essential period of time and is usually cheaper than irreversible life insurance policy. term life insurance for parents. 2Term conversion standards and limitations, such as timing, may apply; for instance, there might be a ten-year conversion advantage for some products and a five-year conversion advantage for others

3Rider Insured's Paid-Up Insurance policy Acquisition Option in New York City. 4Not available in every state. There is a price to exercise this rider. Products and riders are readily available in accepted territories and names and functions may vary. 5Dividends are not guaranteed. Not all taking part policy owners are eligible for returns. For pick bikers, the problem puts on the insured.

Latest Posts

What Is Supplemental Term Life Insurance

Funeral Cover For Old Age

Burial Insurance For Parents Over 80